How do credit counseling and debt management affect your credit score?

As part of our ongoing series to better explain the relationship between credit counseling, credit reports and credit scores, we want to look specifically at how credit counseling and a debt management program (DMP) affect the score. This is a hot topic, and unfortunately one that has been plagued by misinformation. We hope to clear the air and show via data and anecdotal evidence just why the DMP is a recipe for a very good credit score. Our discussion is going to be a bit technical, so if you need a quick answer, feel free to skip to the conclusion.

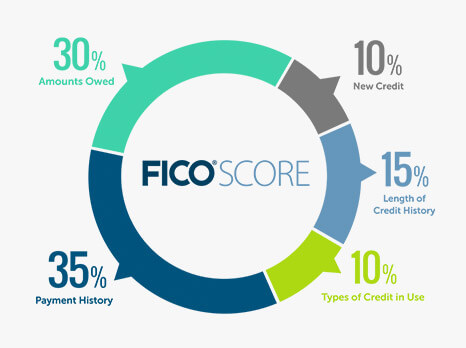

First, let’s remind ourselves of the parts of a credit score, as these will be the foundation of our discussion:

Source: myfico.com

As you can see, FICO places emphasis on Payment History, Amounts Owed and Length of Credit History, respectively, followed by New Credit and Types of Credit in Use, weighed at 10 percent. Let’s take a deeper look at these elements individually to see how a DMP can influence them:

Payment History

When it comes to payment history, a debt management program can only have a positive influence on a credit score. There is one important fact to remember, though—many consumers come to a credit counseling agency because they are in financial distress, and that usually means that they have missed payments and some damage to their credit has already been done. This shouldn’t be confused as being the result of a DMP.

Those who follow the program carefully will be building a strong history of on-time payments, and this will be particularly rewarding after a few years when a “paid in full” status is reached.

Amounts Owed

A debt management program typically has the biggest positive impact on this category. The reason is pretty obvious—as you pay down debt, the amount you owe will decrease. This will then lower your debt-to-income ratio and make you appear much more stable to future creditors. By paying off all your credit card debt, you will be in a very good position in this category. Our average client has over $24,000 in credit card debt, and by paying that down to $0 over the course of several years, they make significant strides toward an improved credit score.

A debt management program typically has the biggest positive impact on this category. The reason is pretty obvious—as you pay down debt, the amount you owe will decrease. This will then lower your debt-to-income ratio and make you appear much more stable to future creditors. By paying off all your credit card debt, you will be in a very good position in this category. Our average client has over $24,000 in credit card debt, and by paying that down to $0 over the course of several years, they make significant strides toward an improved credit score.

The main downside here has to do with a potential short-term impact in some circumstances. If you’re not familiar with the term “credit utilization” it’s the ratio of the credit you have available (your total credit limits) to the credit you are using (your total credit balances). It’s a number that consumers are encouraged to keep low, and those with high credit scores typically keep the number below 10 percent. Of course, if you’re experiencing financial difficulty, that may not be feasible.

The reason this can come into play on the DMP is in part due to the fact that you will close your credit accounts. We’ll talk more about this later, but for now you need to understand that closing accounts can impact your utilization, though it doesn’t always. In some cases, your utilization won’t change at all when you close accounts, because your credit limit and balance will still be reported. In other cases, it can change significantly due to part of your credit background no longer being reported. Here’s a good overview of some unique situations, provided by a moderator on the myfico forum:

- If a closed credit card account with a balance continues to report the original credit limit, then both the balance and the credit limit of the closed account will be used in the utilization calculations.

- If a closed credit card account is reporting a zero credit limit, even if there is a balance on the credit card, the card will not be included in the calculations.

- If a closed credit card account is reporting a non-zero credit limit but has a zero balance, the card will not be included in the calculations.

- If a closed account reports a credit limit that is equal to the balance (balance chasing), then this will be included in the calculations. This is the worst-case scenario with regard to utilization.

Again, the impact here will vary greatly depending on the specifics of someone’s situation. Perhaps the situation that would have the biggest negative impact would be if you have several accounts with a zero balance (perhaps you hadn’t used them in several years), but you also have high balances on your other accounts. When you close all of them, those with zero balances would likely stop reporting, and those with high balances would continue. To give a basic example, if you had Card A with a zero balance and 10,000 limit and Card B with a $5,000 balance and a $10,000 limit, your utilization before the DMP would be 25 percent ($20,000 in total limits divided by $5,000 in total balances). On the DMP, that could potentially increase to 50 percent if Card A was no longer reported, which could impact your score (be sure to keep reading about how those scores tend to surge later).

Length of Credit History

This category is perhaps where the relationship between a DMP and credit scores can be most confusing, and where the most misinformation has spread. The reason for this stems from some basic requirements as part of a DMP. As we mentioned, clients must close their credit accounts while on the program and aren’t able to open new accounts for the duration of their repayment (though some exceptions are made).

It’s tempting to think that these requirements would have a significant negative impact on the “Length of Credit History,” but there is much more to the story than meets the eye.

When a credit account is closed, its age continues to contribute to the overall age of your credit history for ten years. It’s only after ten years that it would drop off the report and then stop counting toward the average. Since a client can expect to only spend three to five years on the DMP, this leaves plenty of time to build back the history. Once the program is complete and a consumer is able to open new credit accounts and manage them responsibly, the impact of closing the accounts can be extremely limited.

Also, while this category is certainly a large part of the FICO model, its importance may be overstated, particularly for consumers who are strong in other categories. For example, there are stories of young people building a strong credit profile, like this 22-year old with a 750, and they obviously don’t have a long history. This isn’t the category to lose sleep over; with patience, you will build back a positive history in no time.

(One other note: our counselors advise clients on how to close accounts in the manner most favorable to them. While it doesn’t directly affect your credit score, the way in which your credit accounts are closed can make an impact on how you are perceived by lenders. You’ll want the records to show “closed by consumer” instead of “closed by creditor,” if possible.)

New Credit

New credit shouldn’t be a factor while on the DMP, since clients typically aren’t able to open new accounts. Once off the DMP, clients will be more skilled at managing money and credit, and should pursue new credit in a responsible way, leading to further credit score improvements and/or stability.

Types of Credit

Similarly, types of credit in use shouldn’t be hit too hard. The closed accounts will continue to contribute to the distribution of account types and thus any impact here should be minor. Of course, once they come off the report after ten years, you may need to revisit the diversification of your credit. But, it’s more important to maintain a level of credit that you’re comfortable with than to attempt cracking the FICO code by taking out multiple types of credit and loans.

Does paying through a third party hurt at all?

There’s one last concern we want to address. Some consumers fear that by seeking credit counseling or paying their creditors through a credit counseling agency, this will directly take points off of their score. That’s simply not true. First of all, keep in mind that talking to a credit counselor and having a session with them is not documented at all with credit reporting agencies. If you embark on a DMP, there is a chance that documentation along the lines of “Paying through a third party” will be added to your credit report, but this will have no bearing on your score.

So, what’s the real result?

So far we’ve been discussing how individual categories are affected, but what’s the big picture outcome? There are a few ways to look at this.

What Our Data Says

The first place we look for answers to this question is in our own client data. To better understand how credit scores are affected by DMPs, we monitored a group of clients for the first three years of their DMP. In that group, we saw clients go from an average score of 529 to 635, an increase of 106 points. Here’s how that broke down for each year:

Year 1 – 61 point increase

Year 2 – 33 point increase

Year 3 – 12 point increase

Once the debts are paid off in full (at the conclusion of the program), we would expect another bump up in the score (all things held equal).

Anecdotal Evidence

While data is helpful, personal stories can share even more insight. Here’s a look at a few clients who saw credit score improvement on the program.

Al

Our client, Al, wasn’t budgeting and didn’t have his finances in order. His credit score had suffered too and was in the 300s. In less than two years, he saw that increase to over 650! The video is pretty pixelated, but it’s worth a watch!

Jessica

Another client we interviewed for this article, who asked to remain anonymous (we will call her “Jessica”), had a success story about a quick credit recovery. In her words: “When I first started the program (May 2011) my counselor pulled my score at 462. By August 2012, it had jumped to 608. A few months before completion (May 2014), it climbed again to 631. It’s continuing to trend upwards as those older accounts drop off.”

Her initial surge is impressive and her overall story is a great example of the nuances here. For example, what seems to be holding her back at this point are a few lingering pieces of negative information (the older accounts she referenced), but those really have nothing to do with the DMP.

Donna

The last example goes to show that even just credit counseling (without enrolling in a DMP) can have a positive impact. Our former client, Donna, never signed up for the DMP because it wasn’t a great fit for her situation. She did, however, work with a counselor on a few different occasions to get budgeting advice and clarification for some questions she had relating to money management. The outcome for her was a score increase of 50 points in just eight months, as the result of small but impactful changes she made, such as lowering her credit utilization.

A (Potential) Drop Followed by a Surge

Experience shows us that what typically happens with credit scores for DMP clients is that they may experience a slight decline early on (if any at all), followed by a strong surge in their score early in the program. Closing accounts has a minor impact, but not as much as you might expect. As the debts are paid down, the credit utilization begins to drop, helping the score increase and payment history improve.

Once a client has paid off their debt, and the program concludes, we then anticipate another score increase. At this time, a client’s utilization is very low (which is great for their credit) and they are in a great position to take out new credit (if needed), which when used responsibly will help bolster the score even further.

Comments

Leave feedback or ask a question.

No responses to “How do credit counseling and debt management affect your credit score?”