Student Loans and Credit Scores – A Powerful Combination

At this point we are all familiar with the problems that student loans are creating for recent graduates and even for those who graduated years ago. But one important topic that is often overlooked is the effect student loans have on credit scores. As it turns out, student loans and credit scores form a powerful combination. Together, they can make or break your financial future. If you don’t take important steps to manage the debt, your credit score could be seriously impacted. And, most importantly, this can have a lasting negative impact, making it more difficult to buy a car, get a mortgage, or reach other financial milestones. We are going to explain how student loans impact your credit score and teach you strategies to keep your credit in good shape while managing student loan debt.

How is a credit score determined?

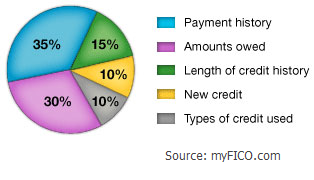

The primary credit score, the FICO score is determined according to five factors. The chart below is a guide for how the FICO score is calculated for the general population. It varies by individual, depending on each unique financial situation.

Why do I need a good credit score?

A good credit score will earn you better terms when you borrow money, such as with a car loan or mortgage. It can even affect your ability to get a job. So, if you struggle with your student loans to the point that they hurt your credit score, you might be setting yourself up to receive bad loan terms. Take a look at how the terms for a $10,000 car loan vary by credit score:

| FICO® Score | APR | Monthly Payment |

|---|---|---|

| 720–850 | 3.378% | $292 |

| 690–719 | 4.811% | $299 |

| 660–689 | 6.922% | $308 |

| 620–659 | 10.809% | $326 |

| 590–619 | 15.397% | $349 |

| 500–589 | 16.924% | $356 |

How Delinquent Student Loan Payments Affect your Credit Score

Student loans begin to hurt your credit score when you miss a payment. When you fail to pay on time, you have essentially violated the promissory note, which is the legal document you signed with the lender.

Luckily, a delinquent status won’t hurt you right away. For federal loans, delinquent accounts are not reported to the credit bureaus until they have been outstanding for 90 days. So, if you miss a payment by a week but are then able to repay, you will avoid any damage to your credit score. Just keep in mind that this payment must be the at least the amount needed to bring your loan back to current status.

If your loan remains delinquent for 90 days, your lender can then report it to the credit bureaus. When this happens, your credit score will take its first hit. How this affects you will depend on the severity of your situation and the status of your credit score before the delinquency. A drop in credit score wil typically make it more difficult to do the following:

- Rent an apartment and sign up for utilities

- Get a job

- Get a contract cell phone

- Take out a new loan such as a car loan or mortgage

Even if you are able to do some of these things, chances are you will be given less favorable rates, making the borrowing more expensive. It’s important to be proactive if you miss a payment or think you might miss a future payment.

Student Loan Default Poses Serious Threat to Credit Scores

It gets even worse if your delinquency continues. If your delinquency lasts for 270 days on a loan that is paid monthly, it moves from delinquency to “default.” For FFEL loans paid less than monthly (for example: a loan with quarterly payments), default status occurs after 330 days. When you have defaulted on a loan, the consequences are far more serious. At this point, your credit score will take a hit and:

- Your loan becomes ineligible for deferment, forbearance, and other repayment programs

- Your wages can be garnished

- Your tax refunds can be withheld

- You may be ineligible for state and federal aid

- Your account is sent to a debt collection agency

- You immediately become responsible for the entire unpaid loan balance along with collection fees

As you can see, the consequences of defaulting on a student loan are serious, and the impact on a credit score is significant.

How to Protect Your Credit Score from Student Loans

There are several ways consumers can prevent student loans from hurting their credit scores. The key is to communicate with lenders and act early.

Rather than waiting for the student loan to reach delinquent status, consumers should reach out to the lender as soon as they realize they may miss a payment. Depending on the type of loan, the consumer may be able to avoid making payments due to unemployment, economic hardship, military service, and other types of deferment. Many of these programs last for three years, and during this time the interest and principal are frozen. Contacting your lender early could mean saving thousands of dollars and avoiding damage to your credit score.

Even if you don’t qualify for deferment, you might try forbearance. This program allows you to stop payments or reduce payments for up to a year. In this case, interest still grows, but at least you are not expected to pay in full. You can qualify for forbearance for a number of reasons, one of which is that the total you owe each month for student loans is 20% more than your total income.

There is also a program called “discretionary forbearance,” which means that the individual lender decides whether to extend the program to you. If you can make the case that you are experiencing a hardship and cannot make the payment, they may be able to make some sort of arrangement with you.

To ensure that you get some sort of help and avoid damage to your credit score, follow these steps as soon as you have difficulty:

- Contact your lender(s) to explain your situation

- See if your situations meets Federal deferment or forbearance eligibility guidelines

- If not, continue to contact your lender about a discretionary forbearance or hardship program

- Sign up for student loan counseling to help you explore all of your options and make the most of your monthly budget

Using Student Loans to Improve Credit and Build Credit History

So far, we have discussed the ways in which student loans can completely wreck your credit score. Hopefully, that won’t happen and you can use strategies and programs like deferment to help lighten your burden while you get back on your feet. For those who are able, following this guide on the best way to pay off student loans can be a great strategy to get out of debt and build up a solid credit score.

But in some cases you can actually take advantage of student loans and use them to improve your credit score. If you are budgeting wisely and making the monthly payments, you could see a big boost to your credit score over the course of your student loan repayment.

This is significant because we know that college-aged consumers are having a hard time building credit. Young consumers are having a harder time getting loans and credit cards and are even turning to more dangerous credit options with hidden fees and more dangerous terms.

But you can avoid this altogether and build a solid credit history just by making your student loan payments each month. If over the course of an average repayment (10 years) you can keep your accounts current, you will be in good shape. Even getting ahead of your payments is a good idea, if you are able. Some people are concerned about damaging their credit score by closing an account too soon, but this shouldn’t be a problem with your student loans. In fact, if you are able to pay off your student loans early, this will likely mean that you made consistent on-time payments and will thus have a much higher credit score than when you started repaying the loans.

Student loans and credit scores create a powerful combination. It’s up to you to determine how that power will be used. If you neglect your loans and don’t communicate with your lenders, student loans will hurt your credit score. The damage to your credit score might be so significant that you can’t get other loans, and that would be a tough financial position for anyone.

On the other hand, if you budget effectively and let the lenders know when you need some extra help you can create a promising financial situation for yourself. You can use the first few years after college to build a solid credit history, making financial milestones more achievable for you later in life.

Athena Olinger

I recently consolidated my student loans and i requested from nelnet ( now paid in full a complete accounting from inception to close and they said that anything for 2013/14/15/16 they have made a internal.decision not to.send me. Can they legally not send me my account information?

Thomas Nitzsche

Hi Athena, we can’t give legal advice, but at the very least it’s a best-practice for companies to provide whatever history documentation a customer wishes. I would ask for your request to be escalated. If necessary, ask for instructions on filing an “executive complaint with the office of the president” of the company. You could also file complaints with the Consumer Financial Protection Bureau (CFPB) and the Better Business Bureau (BBB). Good Luck!

Timothy Starks

My wife graduated in 2013 and her loans were in deferment and are again now. When applying for her most recent deferment the loans were actually behind. So once the deferment had been processed it was done in a way that left a 90 day late on all 7 obligations. Is there a way to apply for a new deferment so to speak that back dates the deferment so it wipes out the 90 day late? Is there anyone to get this 90 day late removed? Goodwill late removals seem to be non existent with NelNet. Please help.

Adam

My student loans are with Nelnet. I’m in the forbearance program for one year.

Last two cycles the credit bureaus decreased my credit score by -8 each cycle for four types of loans. I called Nelnet and they said last month they were told to start reporting increases or decreases in balances which indeed are showing up in my credits reports just like any other loan.

Thomas Bright

That’s a bummer, but a good data point that others should be aware of. Thank you for sharing, Adam!

Kimberly

Hi!

I just graduated college in August 2016. I am in the grace period for paying back my loans. The department of education recently transferred my loans to FedLoan. With this transfer came a credit score drop of 51 points! This has damaged my credit tremendously. Is this normal? I have no payment history on the loans as payments do not begin until March 2017.

Thanks!

Thomas Bright

Hi Kimberly,

Well, there is a concept of “neutral transfer” which is supposed to happen in these cases. So even though you have a new account on your report, it’s really an extension of the credit from the original account and your credit score shouldn’t be impacted. If nothing else has changed in your file (no inquiries, new credit cards, new balances, or any of the like), you might consider checking in with the credit bureaus for an explanation of what’s going on.

Katherine

Hello. I currently have my student loans in default. They list as closed in 2011. They were opened in 2008 and never paid. I’m not sure when the actual deliquent status went into effect. My question is simple. I am in a situation where I’m able to pay the student loans in full right now. If I pay them in full right now does that mean that 7 years after the 1st deliquency the negative remarks will be removed from my credit score? I do not want to do the rehabilitation, I just want to give them $17,000 and get them out of my life but ECMC will not just remove the negative remarks if I pay it in full so it’s still a waiting game. We want to buy a house and just want this debt gone. Any suggestions are appreciated!

Thomas Bright

Yes, that how it should work. It sounds like you have your plan, but here’s how I would look at it–it’s going to go off in 7 years even if you start making regular payments now. If you just paid the minimum from here on out, you could save that big chunk of money for your home’s down payment or any emergencies that pop up. Just a thought. The flipside is that you might (likely) get a lower interest rate on your mortgage than your student loan, so paying the loan may be the better deal long-term.

Cristina

I have a question. My sallie mae loans were in default, and transferred to Navient. But, the school I attended didn’t uphold their end of the contract. I have seen on tv the class action suits against the school I attended. How can I dispute the charges, since I believe that they did not uphold their part of the agreement and get the loans forgiven?

Thomas Bright

I wish I had more info on this, Christina. But it’s not my expertise. I would consult a lawyer and/or the CFPB.

Athena Olinger

Did the school.close? Did you graduate? Did the school misrepresent their career placement numbers?

Any of these can work in your favor

I worked at LCB-LA. And i encourage all students ALL to call and see.If they qualify. But do.it soon you never know what any new administration will change

Will

My student loan is defaulted and I owe around 3000.I have the money now to pay it off in full.Would it help my credit score to make payments 500 a month for six months or pay it off in full. Thanks

Thomas Bright

If it’s federal, going through the rehabilitation program may help your credit in the long run by getting rid of the default. Otherwise, paying it off as soon as possible should save you in interest.

AP

Student loans went into default because of financial struggles. Payment was made 93 days. Unfortunately, credit score plunged 122 points because of this! Will the payment reverse the plunge or will I be stuck trying to dig out of the hole?

Thomas Bright

Restarting a positive payment history will never hurt. But if these were federal loans, you might qualify for the loan rehabilitation program, which is a one-time opportunity to have a default removed. Check it out here: https://studentaid.ed.gov/sa/repay-loans/default/get-out

Wendy Allen

I have student loans from Sallie Mae from 2006 (that state closed 2013 on my credit) The loans from Sallie Mar were transferred to Fed Ed. Those loans also states closed 2011. What does it mean if it states account closed? Some accounts state closed for seven years or more. Should I still be concerned about trying to pay them or is the account actually closed? My credit score was not good but it has gone up considerably in the last year even though I have not paid on them. Why is that?

Thomas Bright

Wendy, it’s hard to say without knowing more. Some of the “closed” statuses you are seeing are simply protocol when the loans change hands. I doubt your student loans would be totally closed without paying them off or having an arrangement in place with the servicer, though it sounds like neither of those happened. Are you sure they weren’t sent to another servicer (other than Sallie Mae or Fed Ed)?

Alex

I have been having a hard time since graduation and have been late on my loans a few times, but have continually gotten deferments. I did not realize my Perkins loan was going into default. The school says they tried to call multiple times (I do not think they did, as I always pick up numbers from campus, but avoid 800 numbers, which I do not believe they would be calling from). They say they spoke to my father, which was never mentioned to me. They say they sent the paperwork to help me repeatedly, and when I asked where to, they gave a Texas address (I’ve never lived in TX!). The last time I had spoken to someone was last Fall and I gave them my most recent address and my new email, but did not get any paperwork. I also didn’t follow up, because I have a lot on my plate now and for the last two years. They have sold my Perkins loan off to a collector, who wants almost a grand more than it was worth. Now, I could go back to school, except the two small Perkins loans are in default. I talked to the school and they seem not to be able to do anything. I talked to the collection agency and they recommended consolidation.

The concern I have with consolidation is that the default will stay on my credit report, because it’s a Perkins loan, until it’s paid off. If it’s consolidated, there’s no way for me to access only that loan, right? I am worried that in the future, I will have to take out graduate Plus loans, and that this will stop me from being able to do so.

Do you have any advice for getting it removed from my credit report with consolidation? Is directly paying it off without consolidation my only option to get the default off my report? Will the default stop me from being able to successfully secure Plus loans? I’m going nuts trying to figure this all out. Thanks in advance.

Thomas Bright

Hi Alex,

Sorry to hear about your troubles! The good news is that there is a Perkins rehabilitation program, which may help in your case, and can get the default removed from your credit report. Check it our here: https://studentaid.ed.gov/sa/repay-loans/default/get-out

Alex

Thanks! I actually had to tell them about that program myself. I thought they were supposed to offer it!

Cathy

I had a student loan with Sallie Mae around September 17,2008 which has been turned over to Navient… When is this coming off my credit report???

Thomas Bright

That record will likely remain on your report for 10 years from the original date. However, this sounds like a “neutral transfer” that should not have a negative impact on your rating. However, if there were negative marks associated with the loan before it was transferred, the impacts from that will carry over even though the loan transferred.

Troy

I pay my loans on time. In 2012 the loans were automatically transferred from the Dept of Ed to Navient. I have had the loans since 2002. This hurt my credit by shortening my age of credit history to below 5 years. Can this be fixed?

Thomas Bright

Troy,

I’m not aware of a way to change this. However, anyone reviewing your credit report (for a new loan, etc.) will be able to see the natural path of this account, from one servicer to the other and should not hold that against you. Also, while you may not be able to see it, the new account was likely created with a code for “remark” or “transfer,” which helps reinforce the fact that this isn’t new debt for you.

MFO

Just got married, filed jointly and our joined income led my school loan payments to be too high. I could not negotiate a lower rate. I understand after letting your loans fall delinquent (me 120 days in order to file married but separate with IRS and adjust my income) that this report will be on your credit report for 7 years. Ouch! Recently, I was in this unfortunate position. My credit score was previously 715 and has dropped to the mid 500’s since the Fedloans reported my delinquency. I currently have my account caught up and plan to pay in a timely fashion with a new more affordable plan. My loans are Fedloans; I do not qualify for the loan forgiveness program. Will my credit be ineligible to improve since this report? Can you tell me how long it might take me to rebuild my score to 700? What’s the best way to rebuild your credit score in this next 7 yrs? As a newlywed, I frightened I may have ruined our chances to find an affordable home loan in coastal CA. Please advise. Thank you for all you compassion in providing us info.

Thomas Bright

Hi,

I’m sorry to hear about these challenges. It’s hard to predict your exact credit score turnaround, but there are some steps you can take. Do you have credit cards already? If so, try to have little or no balance on them, which will help with your utilization. Also, avoid closing credit accounts. You could also ask for higher credit limits (which will also help with utilization), but there might be some drawbacks to that, such as a mortgage lender down the road not liking how much credit is extended to you. If you don’t have cards, you might want to get a secured credit card to start building up your score. Using that for a while might be enough to bump you up to qualifying for a standard credit card.

danielle

I had two federal loans opened through Sallie Mae in 2005. I had made payments for awhile and then it went into forbearance. Moving forward I never made an effort to use the additional months I had for the forbearance and I defaulted. The two loans were then (transferred) in 2012 to Navient. Immediately, once the transfer happened, it was in ccollection, and was just transferred this past week to a new collection agency. I’ve actually agreed to a rehabilitation program with this current agency. However, she said my account is showing 4 loans not 2. I check my credit report and sallie mae is reporting the original 2 loans has them as transferred $0 balance owed. However, the 2 same loans show up on my report by usa funds. My question is if they were transferred, should Sallie Mae still show up from loans from 2005 if they were sold off? Also, what’s the difference between Navient, USA Funds, and the collection agency? Why must I make the payments through a collection agency who wants to charge me an additional 16% collection transfer charge?

Thomas Bright

Hi Danielle,

Yes, typically your credit report will show the full history of an account, including the transfers. USA Funds contracts with Sallie Mae, and Navient is actually a wing of Sallie Mae. So, if I follow you then it went from Sallie Mae to Navient to USA Fund (collections 1) to new agency (collections 2). My best advice for the collections fee is to try to reach a prompt agreement with them (in writing) and see if you can leverage that to negotiate (and possibly remove) the collections transfer fee.

carol

My husband took out a private Sallie Mae student Loan in 2005. In 2009 the loan became due but we were unable to afford the minimum payment. We tried to negotiate a lower payment but Sallie Mae refused to lower our minimum payment. They did however put the payment on hold a few times. In 2011 we pulled our credit reports and it stated that the loan was scheduled to go into a positive status by October 2017, but we checked our credit report again in 2015 and the credit report stated that the account is scheduled to continue on record until Mar 2019. In 2012, the account was charged off . Since we never made a payment shouldn’t this be coming off our credit report sooner than 2019? What can we do to get this off our credit report?

Thomas Bright

Hi Carol,

You may want to call the lender or servicer to get clarity on the exact dates. However, the mark should stay on your credit report for 7 years from the missed payment that led to charge off. It sounds like maybe that was in 2012 for you, and so 2019 would be year 7. Still, it’s worth calling and talking through it with them, especially since you’d previously been told something else.

SA76

Hi,

I have two student loans that were fully rehabilitated and sold in May of 2015. At that time, the current status of both accounts changed to “Paid as Agreed”. While cleaning up my credit report, I noticed that the original loan account showed as being closed in January of 2013, but reported late payments through June of that year. I disputed this with Equifax, and the late payments came back verified. Additionally, the current status changed to “180+ Days Late”, causing a substantial drop in my credit score.

I went around and around with the original lender and Equifax – both directing me back to the other. I researched and found that the guidelines for the DOE Loan Rehabilitation Program state that “The prior holder of the loan….. request that any consumer reporting agency to which the default claim payment or other equivalent record was reported, remove such record from the borrower’s credit history.”

I have sent yet another dispute to Equifax citing this. Am I correct that reporting these accounts as currently 180+ Days late, coupled with the 15 months of late payments would count as a record “equivalent” to a defaulted status? I sure hope so! I’m trying to get a mortgage and I’d just like to recoup the points that I lost as a result of this issue.

Thanks!

Thomas Bright

Please don’t mistake this as legal advice, but I do think you are correct that the current reporting could be a mistake. I would stay in communicaiton with both parties as you have been doing, but are there any other players? Was there another lender who serviced your loan prior to the sale in 2015? They might be good to reach out to as well.

SA76

Thanks for your reply! Yes, the loan, once defaulted was transferred to the DOE Default Resolution Department who serviced it through its rehabilitation. I did reach out to them and they provided me with documentation that the loan was rehabilitated and is in good standing. I forwarded that to both Equifax and the original lender.

Thomas Bright

Perfect! Hoping this works out in your favor very soon!

goodgirl

I have a student loan that when bad 90 days pass dues on

12/2012 and I it payed and closed on 11/2015 and I have tried to dispute they will not remove it , its by navient student loans and since they removed it, I was told in 7 years it should fall off, what year will it come off,

Thomas Bright

It should be 7 years from the missed payment, so that puts it at 2019. If it was a federal loan, you could look into the rehabilitation program, which can get negative marks removed permanently, though I’m not sure how it treats closed accounts that have been paid of or if it can be used for those.

scott

If your student loan is in defaultand your credit score is 602.and it has not been in default very long.if i pay it off how long will it take me to build my credit back up to 625

Thomas Bright

This is really tough to predict. However, if that’s a federal loan you should definitely check out the Rehabilitation program, which can get the mark removed completely.

Jerry

Hi there,

I have a student loan in default. The original creditor was sallie Mae and now FedLoan Servicing holds the account. Under comments in my credit report it says assigned to a govt collection account, however the status says estimated removal is 3/2020. My understanding was student loans were the only mark on your credit that doesn’t get removed in 7 years. Will this loan get removed in 2020 or is that information incorrect?

Thomas Bright

That should be correct. Here’s an article for further reading that may be very helpful: http://blog.credit.com/2015/04/how-long-can-student-loans-hurt-your-credit-112831/

Mike

What kind of credit score

Do you need to get a private student loan for $1000? I currently have a steady source of income

Thomas Bright

A wide variety of credit scores can qualify you for a loan. 650 is sometimes thought of as a “fair” credit score, and I’d imagine you’d have some options there. If your score is higher you can expect more favorable terms, but I’d imagine that even with a lower score you would have some options. Beware of interest rates and good luck to you!

Candy

Hi Thomas,

Thank you for this excellent article and for answering questions!

I have a current loan with some 5 year old delinquencies. My other student loan doesn’t show those delinquencies, they seem to have been lost in the transition to a new servicer of the federal loans. I’m now in a place I can pay off the one with the delinquencies entirely. I’ve also received offers to refinance the student loans for lower interest rates. My oldest credit card is over 10 years old, and my newest is 2. I have 3 credit cards. I had a mortgage with perfect on time payments, which was closed in 2012.

my question is, for optimal credit score improvement:

-is it better to just keep paying the loans monthly?

-would I stand to improve or remove the late marks by paying off the one loan entirely?

-would it improve my score or give a chance to remove the late marks by refinancing the student loan?

-or, are there other techniques I’m not sure about?

I’d like to buy a house so I’m hoping to make as much improvement in credit score as possible!

Thanks! Candy

Thomas Bright

Great questions Candy!

I’m wondering if these are federal or private loans, and if they are federal you might consider the rehabilitation program, which allows the negative marks to be removed after nine consecutive payments.

If you’re able to pursue this, then that might inform your other strategies. Personally, I think it’s great to pay off the loans in full if you are able, but if you feel that extending the payment helps you save for other goals, that might be a better option. While there may be some credit benefit for extending the payment, I doubt if it’s significant enough to warrant that strategy, but this again depends on your specific situation.

Refinancing shouldn’t have a major credit impact either. There will be a new inquiry and then a new account, but if you’re putting yourself in a better position to pay off the loans and minimize your interest then that’s a great option. That said, refinancing also won’t remove negative marks

Best of luck.

Gina

Hello,

My 2student loans went into default. I am currently in the loan rehabilitation program. From my understanding, after I make 9 consecutive on time payments, the negative information about my loan will be removed from my reports. This is one of the benefits of the student loan rehabilitation program. My 2 questions are will this make my score go up and have you ever heard of this program?

Thanks

Thomas Bright

Yes, that’s absolutely a great program and one of the best perks for federal loans. Once that information is removed, your credit score should not be negatively impacted by them anymore. Best of luck!

cb preston

On Dec. 17, 1997 My first student loan was acquired. It defaulted, and not a single payment has been made since Feb 26, 2009. I have no intention ever of paying this, and I’m waiting for it to fall off my credit report. Sometimes I hear “drops off in 7 or 10” years, but all across the net, even on Experian and Navient websites say that charged off loans stay on the report for 7 years. This month to the date is 7 years. How do I know for certain if I can expect this to fall off soon or if I have to wait another 3 years? It was a Salie Mae loan whose information on my report changed to Navient a couple years back. As well, today, an extra 60 dollars was added to the balance. I have no idea why.

Thomas Bright

Yep, this should fall off after 7 years. If not, you can file a dispute with the lender and the credit bureaus.

Brandon

I recently had my tax return completely offset to help repay my student loans. When that five thousand dollar offset is applied to the student loan debt,that should then help my score out a little right?

Thomas Bright

That can be a great use of your refund, but you may not see an immediate impact to your credit score. Installment loans typically don’t affect your “utilization,” which is part of your FICO score, as significantly as credit cards. If you were to pay off a credit card balance (or reduce it significantly), that could have a pretty immediate impact on your credit score by lowering your utilization (how much credit you have available vs. how much you are using). Your student loan, though, doesn’t work this way–at least not to the same magnitude. Installment loans help your credit score more significantly when you have a good history of on-time payments, and they add to your “types of credit.” That said, if paying off a big chunk of your student loan is able to help you find some stability and peace of mind, all while saving on some interest, it’s a great use of the funds and can help your credit score in the future as you have more money to pay down other debt and continue to make on-time payments.

Bells

Hello, I recently been accepted into fed loan servicing loan forgiveness program. Before this I was with nelnet and my credit score was 654. When my student loans were transferred to fed loan servicing my credit score dropped 54 points! Can I dispute this? I didn’t stop paying for my loans they just got transferred. What do I do? I worked really hard for years to increase my credit score now I’m back to square one.

Thomas Bright

Hi there, switching your servicers should not impact your credit score. I would thoroughly review your credit report (you can get it for free at annualcreditreport.com) and make sure something else isn’t going on. You can also submit a dispute. We talk about how to dispute items in this article.

Jennifer

I consolidated my loans to make it easier for repayment. My score dropped 43 points when navient reported all the other accounts as closed with the one account with the same amount in good standing.

Kena

Hi. My checks are starting to be garnished for student loan 5000 will that make my credit scores go up being that the payments are in time. They have been taking my taxes for the last 5 yrs now. I believe my way of thinking I would just let them take my taxes weren’t a great idea

Thomas Bright

Sorry to hear that you found yourself in this predicament, but at least it sounds like the situation is currently manageable!

erick rice

I owe student loans of 13,000 dollars,been in default 3 years and I’m wondering if I pay the whole bill off in one lump sum will my credit score go up significantly?

Thomas Bright

Well, that negative mark will remain on your report and will offset some of the gains your credit might make from paying it off. That said, it still may be a good idea to pursue that (especially if you’re experiencing wage garnishment). One very important point: are these federal loans? If so you should absolutely look into loan rehabilitation, as that may allow you to clear the default mark. Best of luck to you!

Ashley

Hello. I had a scores of 720 -739. I just consolidated all of my student loans and now more scores have dropped to around 680. How long will it take for my scores to recover? I want a new home and I am afraid I will not get approved

Thomas Bright

Hi Ashley,

Opening a new loan for consolidation purposes typically involves a hard credit inquiry and can lower the average age of your accounts. These two things both tend to affect credit scores negatively, thought your drop is larger than you might have expected. The good news is that by making consistent on-time payments, the score should increase over time. It’s difficult, however, to predict how quickly that will happen.

Did you check your credit score with the same company both times? Sometimes different credit score models will give different results, so it’s important you are using the same source when you check.

Steve

Hi,

Thanks for taking the time to read and respond.

I’m trying to clean up credit report and catch up paying off my student loan debt. There’s a defaulted Perkins Student Loan that I lost track off and have a collection agency calling me. This defaulted loan however is nowhere listed on any of my credit reports. All other loans of mine are up to date and current.

I’m thinking of paying off the defaulted loan with one single payment directly to the school that’s holding the loan, instead of the collection agency. However, I’m afraid it’ll show up on my credit report once I do and want to avoid that at all costs since it’s not yet listed anywhere. Also wondering what might be the repercussions of delayed it a bit longer and first paying off other loans that are current but listed on my credit report.

Does anyone know why a defaulted loan with a collection agency might not show up on your credit report? It’s been in default now for about 2 years.

Also, I never finished my degree, wondering if that could be a possible cause for why it’s not my report, since the loan is also held by the same school.

Thanks again for reading.

Regards.

Thomas Bright

Great question Steve, thanks for sharing. I can’t say with certainty why it isn’t on your credit report, but here’s how I recommend that you move forward. I would call the original lender or servicer (not the school, but the company you would have sent payments to before it went to collections). You can ask them why it isn’t showing on your report, but I also suggest asking if there are any rehabilitation programs available. These programs have been proven useful to other borrowers who had defaulted loans, and can restore some positive credit history in some cases. they may direct you to the collection agency, and if so you could call them and ask about “rehabilitation.” Best of luck!

Melinda

Hi,

I just checked my FICO score (which is 784) and was surprised to see that my student loan is not considered or listed anywhere.

Should it turn up under open accounts?

currently only my cretit card shows up as 1 open acount.

Thank you,

Thomas Bright

That’s odd! Student loans should be there under the installment loans section.

Shelly

I just started college I had a score of 650 but now this month my student loan is showing in my credit report my score dropped to 580 I have nothing else new on my report how long will it take to go back up

Thomas Bright

If you are a college student and haven’t had other credit, this sounds perfectly normal. It should start going up steadily once you begin making consistent, on-time payments.

Ashley

Hello,

I always pay my student loans on time. However, I forgot that Friday, “black Friday” is considered to be apart of the Thanksgiving Holiday weekend. Thus forgetting the payment would not be credited or applied right away but Monday (or later) —after the holiday weekend. Unfortunately, because of that little mishap, I technically have one late payment on my account. Will this show up on my credit report even though it was already credited, and to be paid? (Actually went through today). The loan provider is Mygreatlakes, I called and spoke with someone who said they only report as delinquent 30 to 90 days? Should I still be worried or take their word…

Thomas Bright

Ashley,

Sorry to hear about this happening, but it sounds like you are OK. Though you technically become “delinquent” on the day after payment is missed, it’s quite common that servicers don’t report this for 30, 60 or 90 days. I would believe what the rep told you, and breathe a sigh of relief. That said, there may still be a small late fee, and you should keep an eye on your credit report to make sure that it isn’t reported. Also, be aware that federal loan servicers are more forgiving, and private loan servicers may report to the bureaus much more quickly.

Ranger

Nowadays it seems FAR more people are hurt by the Student Loan Debt than ever before. Not so much due to refusal to pay, but more for the fact that they took out Student Loans for college only to find out that the careers chosen have no positions available, now that they have graduated. Then, the loans kick in for payment(s) and unfortunately the graduate took a lower paying job to in order to live, and now can’t afford the payments and they go into default.

The glory days of getting a Student Loan, going to College, Graduating and getting a nice paying career have long gone by my friend. The Federal Government was never designed nor is capable of the operations of Student Loans. Since the Federal Government (basically confiscated) took over ALL Student Loans, the entire system has become corrupt and unmanageable just by looking at the astronomical amounts of debt and defaults today.

As the infamous Ronald Reagan said: The most frightening words you’ll ever hear are; “We are the Government and we are here to help”! Well, the Federal Government has confiscated all Student Loans, and never before in history has there been a larger Student Loan Debt of defaults. Last checked Student Loan Debts were well over $1 TRILLION dollars! Doesn’t seem like they are doing too good of job now, does it?

My heart goes out to those other people who attend the “Diploma Factories” that get you to borrow Student Loans in excess of $10,000 to learn basically low level skills (as medical assistance and so forth) and the student find out, after graduating, that nobody takes Kaplan, Phoenix, Devry, ITT Tech, and others very serious schools. And, they never get hired for jobs. Yet, when that $10,000+ Student Loan debt kicks in, their credit fries. Large Corporations call those places, as mentioned, Diploma Factories and do not hire those people, at least not very often.

I guess as Barnum said: There’s a sucker born every minute!

Education is a Parrot. Nobody ever said the Education is Power.

Knowledge is Power, and knowledge can not be captured in a controlled education process!

Thomas Bright

Thanks for sharing your sentiments! What stands out to me is the need for financial literacy BEFORE we send our kids to school. Student loan debt often doesn’t feel tangible until students have already graduated and suddenly realize they can’t keep up. I think we need to find ways to make the consequences of student loans more clear, and I think many students may change their course as a result (ie go to community college for two years, only consider schools with in-state tuition, gain work experience before going to college, etc.).

Education is still a powerful tool and a solid investment for many, but you are right that we need better awareness around the costs.

Ranger

I agree with your response. Education of the handling of credit is very important for decisions of attending any educational institution. Yet, no diploma factory or any other college ever has that discussion with the prospective student before they get them to sign that dotted line taking that loan. The schools, as any business (which all schools are now profit driven businesses today) are far more interested in that profit, and the care of the student is secondary at best.

I do believe that the defaults will continue to grow to a point that the system either collapses or the Corrupted Congress is forced to act. Which we all know they won’t. Unless ordered to by their owners, the bankers.

AJ Tellez

Hi there,

I went to a private school and took out a loan for 15,000$. On my very last day of completion, the school closed down… I was so mad, I said to hell with the loan. The loan obviously went to default, then the dept. of education said I was eligible for a loan discharge! I’m sending in the paper work tomorrow through priority mail, so I guess my question is, will it be removed on my credit report? Will it bring back my score? And how long does it take for it to be taken of my report if they do?

Please reply

Thomas Bright

AJ, sorry to hear about your troubles! I would run some of these questions by a rep a the Dept. of Education if you are able to speak to someone, and also try to ask the loan servicer. It looks like many times these get marked as paid and full and you can expect an improvement in credit standing. That said, the loan servicer should be able to give you a firmer answer. You might also check out this thread to see how some others have handled this situation and been successful, though your situation is more unique due to the closing of your school, etc: http://ficoforums.myfico.com/t5/Student-Loans/Student-Loan-Disability-Discharge/td-p/2440749

Best of luck.

Lori Smith

How do you have student loans deleted from your account?

Thomas Bright

Lori,

If you’re referring to negative information associated with the loan, such as a loan that went delinquent, that information typically remains for 7 years. The Perkins Loan may stay on it longer, though.

Mike

I have student loans accounts that were closed and transferred to another lender, which is who I am currently repaying. Do closed student loan accounts come off your credit report after 7 years? Will this hurt or help my credit?

Thomas Bright

Hi Mike,

This is fairly normal. The question really boils down to your payment history. If that was good and on-time, then it will continue to have a positive influence on your score. If you missed payments, then those will remain also and can have a negative impact. The closed loan can remain on the report for up to 10 years, negative marks can remain for up to 7.

Here are two potentially helpful resources:

http://www.experian.com/blogs/ask-experian/2013/05/23/transferredclosed-student-loan-history-still-affects-credit-scores/

http://blog.equifax.com/credit/how-long-do-closed-accounts-stay-on-my-credit-report/

Chris

Thomas,

The loans were already listed on my credit report. No immense changes on the balance (a few dollars) and no adverse reports. It’s so baffling. It is also my Fico score. Would that have something to do with it?

Thomas Bright

Ah, that is strange. As for FICO…potentially. If you have checked other scores in the past (such as the free scores provided by sites like Credit Karma), then yes your FICO could be significantly different (even 50+ points), and that wouldn’t really be an apples to apples comparison.

But, if you’ve been checking your FICO all along and that’s specifically what dropped, then I agree that it’s a bizarre change, given the circumstances. Was there a note included with the score? Often there are indicators that help explain why your score falls in a given range.

Chris

I just got an alert that my credit report had changes made. I looked at my report and my student loan company reported my deferment with no delinquency. My score dropped 54 points! I know that deferment doesn’t affect credit scores so, why did this happen?? That’s such a blow to my credit for something that shouldn’t affect my credit! Thanks for any help!

Thomas Bright

Hi Chris,

Was the student loan on the report at all before you received the alert? If the loan itself was just added that could explain it. Or, have any other factors dramatically changed, such as the balances on your other debts?

It sounds to me like something else must be going on in addition to the deferment status.

Kasey

hello, I recently returned back to school and received student loan for 5,000. This is my first and last loan might I add. I am still in school but thought it would have a positive impact on my credit score if I started paying on my loan. Before paying on student loans, my score was 617, since balance has decreased it has dropped tremendously to 580. I’ve made all other card payments on time and this was my first payment on my loan. This the only change that I’ve made. How can paying my loan early have a negative effect on my score?Should I continue paying on my student loan?

Thomas Bright

Hi Kasey,

That is weird and certainly doesn’t add up with the way the scoring formula usually works. Even though your other card payments were on time, I wonder if maybe the balances on those were higher in some cases than they had been previously? That and the new balance of the loan might explain it. You can take a look at your credit report at annualcreditreport.com to make sure everything seems in order, and if you use a free credit score program, those also typically give explanations for why your score is what it is, and that may help too.

Ro

Hi,

I have a two student loans with Navient which were previously with Sallie Mae. In 2012 I began continuing my education with the help of family. I missed 5 payments (on payment which was late consecutively for 120 days). I was able to get help to bring my account current. I have not missed a payment since. I recently tried applying for a private loan and was denied due to the Navient delinquency. I would like to have these delinquincies removed in hopes of if no longer negatively reflecting on my credit.

I keep reading that a GW letter is an option. In regards to the GW letter should this be address to Navient or to the credit bureau? I would also like to know can anyone assist with the exact address for Navient? Lastly is it likely the delinquency can be removed fairly quickly?

Thomas Bright

Hi Ro,

I don’t want to speak beyond what I know, and unfortunately right not I’m not prepared to speak about GW letters (although a long/informative blog post about them is on the horizon). I would imagine that it would be addressed to the lender directly, and if something like that were accepted, they/you would communicate that to the bureaus. I also can’t speak to the chances of it being accepted. Sorry I’m not more help, but thank you for the reminder that this is an important topic that isn’t discussed enough.

Adrian

Hello,

I received a student loan of 5000, which does not need to be paid until December (6 months after my graduation). However, I recently checked my credit score and it tanked around 60 points in the few months since I received the loan. I make every credit card payment on time and usually utilize around 10% of my available credit. I did apply for and receive a new credit card in June, but I have made all those payments on time as well. I got a message stating that my “proportion of loan balances to loan amounts is too high.” Is this solely due to accrued interest? I went ahead and paid it all off. What will help bring my score back up – should I just pay it all off? I will need a new car soon and I would like to keep my credit score safely above 750, where it used to be.

Thomas Bright

Hi Adrian,

It’s always hard to predict these things for sure. It does sound like the drop is associated with the new loan and the recent credit card opening, which lowered the total average age of your accounts. That said, if you continue to make on-time payments, and keep the utilization low (under 10% like you said), you should experience positive changes to the score over time. Paying off the loan may very well help, but you will need to think about that carefully. If you need to finance your upcoming car purchase, it may make more sense to save $5,000 or whatever you have available to put a bigger down payment on that and minimize interest. There are a lot of factors to consider, but again it sounds like you are moving in the right direction with low utilization and timely payments.

Best of luck.

natashia mitchell

I opened a 1000 dollar student loan and I am still in school and it has been reported on my credit report as negative, it dropped my score a whole 40 points for transition and 8 points for experian. I don’t understand if student loans are supposed to help establish credit why did it bring g down my score?

Thomas Bright

I can’t say much without more information, but the key thing is determining why it’s “negative.” Did you miss a payment? You need to determine that and then potentially work with your servicer to get the payments back in a positive position. If you haven’t missed a payment and the negative mark is a mistake, you can also petition to have that removed. For further clarification or help, definitely reach out to us for student loan counseling.

joy

In 2009 I had defaulted on my student loan and when I filed my taxes for that year the Fed took the monies owed from my tax return and paid off the debt. I was under the impression that my loan was paid off until I recently checked my credit report which is showing that I never paid and now owe the money plus penalties!!! I believe I received a “receipt” for the payment, but I do not have it in my possession anymore. I live abroad and have become a resident of a foreign country and no longer have any of my stateside possessions. I will be stateside in a couple months and want to resolve this issue. How can I prove this was paid? How can I fight a credit company?! They are basically saying guilty until proven innocent and if I can’t I have to pay again?! HELP!!

Thomas Bright

Hi Joy,

Sorry to hear about this situation. You can locate old tax returns with the IRS, and I’m guessing there’s a way that they or another agency can provide documentation of where your refund was withheld. You can also contact the lender directly to inquire. That said, are you sure that the amount that was withheld totally covered the full amount of the loan? If it only covered part of the loan (enough to make it “current” again) that might explain why it’s still showing a balance and penalties. If you can determine that it was paid in full, you would then want to dispute it on your credit report by contacting all three credit bureaus and the original lender.

Leo Ferdinand

I have just started the Loan rehabilitation program at the end of it and I have made all the all time payments, What impact will it have on my credit score once my loan is out default?

Thomas Bright

Leo,

This likely depends on the lender. The default may disappear from your credit report, but previous late payments may remain. After some brief research, it looks like sometimes the slate is wiped clean entirely, and sometimes the negative information is not removed. You might want to ask your lender specifically, and prepare for phone and written correspondence with them to ensure this is handled properly.

Here’s a resource with more information and some anecdotal evidence: http://blog.credit.com/2014/09/the-truth-about-student-loan-rehabilitation-and-credit-reports-94730/

Best of luck!

Cheryl

As a parent borrower, I have had no issues with Sallie Mae. Now that Navient has taken over my payments by check are split even though the statement is included thus I am short on two accounts. No one can explain why except that the new computer system has some problems. The addresses for borrowers for private loans is also an issue. There is no accountability & the harrassing calls continue. I have tried to have anothter company take over these loans but since Navient quickly destroyed my credit score, the answer is no. How can I resolve this issue. Even the customer advocate at navient just states “you are late- find a way”. Help please.

Thomas Bright

Hi Cheryl,

Sorry to hear about this. While I don’t know the full details and certainly can’t give legal advice, I will say this: if you feel as though your accounts went delinquent due to an issue beyond your control, such as a system error by the lender, or you were otherwise treated unfairly, you should contact the ombudsman at the CFPB. They investigate these issues carefully and may be able to help. Good luck!

dan

I had delinquent student loans that were on my credit reports, but have since fallen off after 7 years, they’re still delinquent, can they be re-reported?

Thomas Bright

Great question! They should not be able to be re-reported. You will want to keep a close eye on your credit report to ensure this is the case.

Best of luck!

Kevin S

My question:

I have a defaulted loan now under contract by a collection agency. What would be better for future credit, setting up a rehab payment situation or paying it off in full if I have the current ability to do so thanks to a financial friend???

… or at this point does it matter if I pay in full or make payments my credit is screwed either way.

Thomas Bright

Kevin,

That’s a good question that can depend on quite a few factors, including how large the debt is and your tolerance of risk (after all, consumers can be sued for unpaid debt). What I can say is that generally speaking, paying off a collections account doesn’t improve your credit score since the account remains on your report for 7 years. However, changes to the credit scoring industry are beginning to show more forgiveness here and there can be some benefit to paying it off in full.

For further reading and explanations, I recommend checking out this article: http://www.credit.com/credit-reports/removing-collection-accounts-from-your-credit-reports/

Mack

I had 26k in student loans but them in forbearance until NELNET ran an internal process with the VA to forgive the balance. I am 100% disabled so it should be no problem. Wrong. All three credit reports show the loan paid / closed. Good. Yet over 120 days late. I wrote NELNET with copies of report. I contacted the 3 agencies with supporting documentation of the VA paying in full. My fico is mid 500’s. I do have 3 collection account that will be paid off in 3 months. Will the correction of “paid on time/never late” raise my score?

Thanks

Thomas Bright

Hi Mack,

All things equal, having “paid on time/never late” replace a status of over 120 days late should have a positive impact on your credit score. Let us know how this gets resolved–and good luck!

Mary

My debt to income is over 100%. I am paying my student loans on a Income Based Plan and don’t have any other debt. How can I get my score up?

Thomas Bright

Consistent, on-time payments is a good start. Other than that you would have to decide whether you could comfortably take out a credit card. Using it for small purchases and then paying it back each month (to prevent interest from accruing) could be a good strategy in your case.

Joe

I have about 20, 000 in student loans from undergrad and now grad school (all in good standing), and my credit report has always reflected these loans correctly. However, when I checked my most recent report, that 20,000 in loans appeared three different times under three different lenders — the Department of Ed, Sallie Mae, and now Navient, so that it now appears that I have 60,000 in student loans. This must be a result of the loans being sold/transferred three times, but that doesn’t mean I now suddenly have three times the outstanding debt! Should I be worried that this is adversely affecting my credit rating? Where should I start trying to get this error cleared up?

Thomas Bright

Hi Joe,

I guess depending on how exactly it is notated, this may or may not be a problem. You might start by just calling the lenders and asking them directly. If you feel like you need to dispute the way it is presented, you would write a letter describing the situation and issue to all of the lenders involved and all of the credit bureaus: Equifax, Experian and TransUnion.

Good luck!

Kevin

Hi! Thank you so much for providing such great information! I do have one question, though. My student loans are 311 days delinquent. I finally called them today, as I just started a new job and no longer need to avoid them. They said that if I don’t make a payment by May 20, they will default. So, here’s my question. They said I could either pay $1700ish to bring the loan current, or I could choose forbearance. I think I’m actually able to make the full payment to bring it current, and just keep a really tight budget for a while. If I do that, however, will bringing it current remove the late payment marks on my credit score, or is bringing it current one of those things that won’t erase bad decisions, but is the “right thing to do” whenever possible.

Kevin

Thomas Bright

Hi Kevin,

I think you nailed it on the head in your last sentence. Typically, paying to get it current is “one of those things that won’t erase bad decisions, but is the “right thing to do” whenever possible.” That said, you could potentially call the lender and ask for a courtesy removal, or better yet mail them a letter explaining your situation, that you’ve paid in full and that you’ve liked the marks removed. It’s a longshot but can sometimes work. Check this out to read more about it working for someone: http://ficoforums.myfico.com/t5/Student-Loans/Wow-Goodwill-Letter-Student-Loan-Letter-Really-does-work/td-p/2457579

Good luck!

lisaS

My credit score is 566… it has jumped since paying my bills on time. I educated myself on good credit habits. Thing is. ..I have 10 lines of where it says my student loan was traded. I almost went into default, but caught it in time to prevent that. I’m now on time with my payments. I’m going thru the pay as you earn program(similar to the IBM program). My question is. .. how can I get rid of those 10 lines of traded?

Thomas Bright

Hi Lisa,

Thanks for reading and commenting. It’s great to hear that things are moving in a positive direction for you. as far as the trades, I’m not sure exactly what’s going on there. Did those loans switch lenders? If so (and if that’s the sort of trade it’s referring to), that shouldn’t have a negative effect. It could mean something else, and any specific language about what it says would be helpful to know in order to figure out what’s going on. I would try Googling the exact phrase on the report to see what info you can find, or perhaps call the lender directly to ask.

Best of luck!

Jay

Trying to purchase a home within the next couple of years. I’m in a career, but without a degree. I’m working on my undergraduate now. I will graduate a year after I buy the house. Will a student loan hurt my application if I wouldn’t be obligated to pay it until I graduate?

Thomas Bright

Jay–great question. Since you don’t have a monthly payment on the loan currently, the lender knows that it won’t impact your ability to pay the mortgage until after you graduate. The exception is that you could also quit school, and you would still owe. Long story short–it doesn’t “hurt” you per se, but will definitely be taken into account by the lender and affect how much they will approve you for. In my opinion, that’s not a “hurt” but is a good thing designed to ensure you don’t purchase a home outside of your means.

Best of luck!

asker

Great article.

Amanda

I have a 733 average credit score but I do have a student loan that is in delinquent status, due to my own stupidity. I have made payments ontime for the last 6 months. I checked my credit reports and they say that the loan is paid on time and have no reference of delinquency anywhere. But when I read what factors weighed on my score it did mention that I had a delinquent account, even though its not mentioned anywhere. Anyway I’m looking to rent an apartment wiith my boyfriend who has impeccable credit do you think this will effect anything since my score is pretty high and I’m in good standing with all my other loans and credit cards? Is there anything I can do to fix the delinquency?

Thomas Bright

Amanda, the good news is that your score is certainly good enough to rent an apartment, especially with the addition of your boyfriend’s positive credit rating. If you think you might get a house in the near future, you’ll want to try to get that score up to a 750 or higher so you can tap into the best mortgage rates.

It is odd that your report doesn’t show a delinquency but then says a delinquency has impacted you. I would suggest reaching out to the lender to ask them about the delinquency. Perhaps you might also mention your recent positive credit behavior and see if it could be removed. You might get further if you follow up by submitting your request in writing. It’s a long shot, but worth a try. Even if you aren’t able to get it removed, by maintaining a positive payment history moving forward, you should continue to experience a positive credit trajectory.

Best of luck!

Charles

i have paid my student loan they took my tax return to pay it off that was two to three years ago credit report still shows owed how do i get it off my report

Thomas Bright

You will want to reach out to the lender to ensure that it’s paid off and get some documentation showing that it is. (You may already have something along these lines). Then, you need to write to the three credit bureaus to explain when the loan was paid off and ask them to remove it from your report.

Hope this helps.

cassi

Hi,

I had approximately 24k in student loan which were defaulted many ibr’s, deferments & forbearances, I finally got disability discharge of said loans and now they are reported as closed, but are still on my report. Can I have them removed now and if so how? Or what can I do to improve my 543 credit score due to such a large debt record? Also should I even bother to attempt to get them removed? Is it worth the trouble?

Thx, any and all help will be greatly appreciated…

Thomas Bright

Great questions. It’s always “worth” it in the sense that an improved credit score can make a huge differences for your long-term financial future. The issue is how exactly you should go about getting them removed and whether you’d be successful. I would probably start by calling the servicers of the loans and asking them about the details involved. Then, you would probably want to write a letter to the servicers and the credit bureaus, explaining the situation and asking that the negative marks associated with the loans be removed as a result of them later being discharged. For help, you might also consider reaching out to the CFPB who may have additional resources to assist you.

Jenny

Hello! I came across this looking for some insight to my 6 student loans being held by fedloan servicing. After learning the hard way, I had finally repaired and maintained my credit at about 760. I was repaying my student loans on a wage-based program that had expired prior to my renewing. When the new gigantic amount appeared I placed my account on a forbearance for couple months to reapply. It is completely my fault that I lost track of the date my forbearance was over. However, fedloan servicing proceeded to report all 6 of my accounts at 60 days- resulting in 12 missed payments in 2 months. I saw my credit plummet to 550 overnight- and is in fact how I even learned I was in default. I received nothing my phone or email alerting me to my default. I was in the process of purchasing my first home, and suddenly being unable to this made the event even worse. I called them immediately, brought my accounts current in hopes they would remove at least some of the 12 reported missed payments- I mean, even if they just left two, one for each month, that would be better. They informed me they are actually required to wait 90 days to report, but they would not remove my 60 day accounts because the are in fact accurate. I haven’t contacted the credit agencies because I am concerned if I don’t say the right thing they are going to agree that it is in fact correct- and in all actuality it is. Who “requires” them wait 90 days? Would I be able to take it up with them? Is there anyway to have maybe not all 12 on there when really I missed two payments. I think this is a terrible way for a company that is in charge of federal student loans to handle us- I felt like I borrowed from a loan shark and one mistake they chopped off my hand.

Thomas Bright

Wow Jenny, really sorry to hear that! Not getting payment reminders and notifications via email, etc. can be so frustrating, as can being blindsided with a late notice and credit mark. A 60 day mark may not cause too much damage for you in the long-term, but having 12 of them definitely could (see this article: http://www.credit.com/credit-reports/late-payment-secrets-revealed/). So I think you are right to petition to have them ALL removed, or at least get the number down to two. If it were me, I would hound your servicer and call repeatedly, even if it means having the same conversation with multiple people. Just fully explain that you had been told late payments weren’t reported until 90 days. After many attempts of that going nowhere, then try the approach of getting the number reduced to 2. I’d also try writing the bureaus and your loan servicer to describe this situation. Paper mail is very powerful when it comes to this sort of thing. Again, just lay it out in detail. If they told you 90 days, I would do everything possible to make them honor that.

Max

I just wanted to say that I went thru the exact same scenario as pj said on this forum on January 9, 2015 at 6:47 pm. The rehabilitation program does work like he said. My credit just jumped 46 points when cleared thru the first collection agency. I had two collection agencies managing the payments for 9 months. I am still waiting for the second agency to finish-up the process of clearing my account up, and so the Department of Education sends out the notice to remove this historical data from my credit record. I think I should receive an additional 20 or 30 points increase on my credit when removed from my record.

Anyhow, I just wanted to share the good stuff that can happen to anyone if the rehab program is available to you. The one thing you need to have is patience, and ensure to be consistent and on time with your payments to the end. Its a wonderful feeling to have taken this burden of my chest. I would have done this sooner, but I kept putting it off for a very long time because I was mad, mad at myself for letting it go so far, and thinking it was to late to re-establish my credit up again. Well my message: is never too late to get started, you start by making the phone calls, and situating yourself with the help of the collection agency on the rehab plan. Good Luck to you guys.

Thomas Bright

Max,

Congratulations to you, and thank you so much for sharing your story. This really is inspirational, and hats off to you for staying organized and not giving up. Thanks again for sharing!

Grace

Due to a series of misfortunate events, I defaulted on my student loans and credit cards nearly 7 years ago. I tried everything, from forbearance, differment, disability discharge etc. to no avail to prevent this from happening, but simply found no mercy.

I recently checked my credit report and saw that the last of the loans will be removed from my credit report this year! How will this affect my credit score? And what do I do about the outstanding loans that are still “there”? At this point they’ve been sold and resold. And they were federal loans…do you know what happens after they are removed? I’ve only had one tax return garnished in the time since default…am I doomed for garnishment forever?

Thank you.

Thomas Bright

Grace,

I believe that judgments can be renewed by the lender in order to continue garnishments. However, I don’t have enough knowledge in this area to provide a firm answer or recommendations at this time (without additional research). I’ll do my best to report back with further information at a later time, but to get these answered more promptly, I recommend you call our credit counseling team.

Patricia

Hi,

I am being contacted by a collection agency for a debt that I already proved I paid to the last collection agency and had it removed the last time. In addition, this collection agency is pulling my credit report. How can they do that? Since the debt is paid, they have no valid reason to pull. I’m upset that a credit reporting agency would give out my information.

I’m not sure what to do. Do I contact them? Can they put it back on my credit? Why didn’t the last collection agency destroy the debt once I proved I paid it? The thought I have to now spend my time on a debt that wasn’t valid again is upsetting me.

thanks for your time.

Thomas Bright

That is a tough situation. I would write a letter to the previous collector, the current collector, and all three credit bureaus (Experian, Equifax, TransUnion) to explain the situation and ask it to be corrected. You can also contact the CFPB who helps facilitate the resolution of complaints such as this.

Megan

Hello,

I have a credit score of 752 and have no delinquent or derogatory accounts according to my credit score check. I did have $6,000 in credit card debt because of medical issue, but I was never late on a payment, got an extra job, and will have both of those paid off in May, nine months later.

The only other non-school related debt I have is on a car I’m leasing, and payments are on time and in full.

My question is when I check my credit report, my undergraduate and graduate student loans showed up, and I’m completely aware of those and are making payments on them. I have about $97,000 of them left, but I am making payments to pay off interest and principle and plan to have them paid off in ten years.

I have, however, another student loan account open at the bottom. The loan is for $21,844, but does not show as delinquent. I counted ACS (which the report states the loan is through and which my other two loans are through), and they have no record of it. I also contacted Nelnet (which my undergraduate loans are through), and they said I am up to date on payments and have no delinquent accounts.

Also, the federal website which lists all of your loans does not have this “third” loan listed. It states it was taken on in 2007 the same time as my other grad school loans, so I know they have to be related.

I’m not really sure who else to turn to since ACS, Nelnet, the Department of Education, or Wells Fargo (who sold the loan to ACS) has any record of it.

I’m obviously trying to be extremely responsible about my debt and would love to pay it off if need be, but I am not sure why nobody else knows what it is. My husband and I applied for a loan, and the lender said although my credit is great and my history is perfect, my debt to income ration is too high, so my husband has to take out the loan himself.

Any thoughts on any I have this mysterious loan I’m not paying on and nobody has record of but still showing up on my credit check (without negative consequence)?

Thomas Bright

Hi Megan,

It sounds like you are doing a great job keeping up with all of your financial commitments–congrats! But yes this is a weird situation. If the loan isn’t showing up in the NSLDS, then it could be a private loan. I would suggest calling ACS again and making sure they don’t have a record of it. (They could have sold it to someone else). If you still don’t get anywhere, you could potentially reach out to the financial aid office at your school and see if they have record of the lender and the original loan amount. Also, student loans are notorious for being represented in confusing ways. For instance a total loan amount of $75,000 through one servicer, might really be three different $25,000 loans with different rates, etc. I would double check that the $21,844 isn’t really bundled in with the bigger amount.

Best of luck getting to the bottom of this!

Jessica

FedLoan Servicing reported me as 60 days late on four accounts (four Federal loans that I pay with the servicer). I am trying to purchase a home and these four delinquencies have severely impacted my credit score. I am trying to dispute this reporting based on the fact that my delinquency was less than 90 days and that I received retro forbearance. In the beginning of the article you mentioned 90 day reporting on Federal loans…is that in writing anywhere? FedLoan told me they didn’t implement the 90 day rule until October ’13 and conveniently my delinquencies were reported in July ’13. Any advice would be amazing!

Thomas Bright

Hi Jessica,

Oh wow, I didn’t realize that rule came into place so recently. I wonder if you could convince them to apply that to your situation, as a courtesy. If you want to see the specifics of your terms, though, you may need to look back at the promissory note you signed when taking out the loan. Hopefully, the information you need is in there.

Good luck!

Melanie

Hi! My $21,000 of student loans were 120 delinquent. This caused my score to drop over 100 points. I contacted my lender and they gave be a pre-dated deferment that goes back the full 120 days. Will my credit score raise back to the same that it was previous to the delinquency and if so when should I expect to see this?

Thomas Bright

That’s a really good question. It sounds very promising that they were able to pre-date the deferment. You will just want to make sure that this is communicate properly to the credit bureaus (all three of them). I’d keep an eye on your credit report over the next few months and also consider writing a letter to the lender and the bureaus to ensure this is adjusted properly.

Mae

Hi, so I have really terrible credit. (Was an “authorized user” on an ex’s six defaulted credit cards and had two mobile account go into collections..) But now, I’ve been a full time student since Oct last year, and I just started a full time job this month. I won’t be graduating until 2017, but my question is, given the new job, if I begin making payments now (while I’m not required to and there’s no way I can miss payments at this point in the game) and pay as much as I can, when I can, will I see any improvement in my credit report?

Thomas Bright

That’s a great question. When it comes to paying student loans, you want to do two things: keep interest at bay and maintain a positive payment history. If these are accruing interest, making payments is a great idea because it will save you money in the long term. If they aren’t, it’s still nice to get ahead. However, you won’t have an advantageous credit score effect by doing this (to my knowledge). To confirm, I’d consider calling your lender to ask this specific question.

Juju

Hi! I had good credits before but I checked my credit score a few days ago and it was at 530. It says that I have a c debt of $90k from student loans. I havent done any payments because I am still in school. What do I have to do so I could have good credits again? I was told by my FA advisor that I can start payments when I’m done with school. Should I start paying my loans now? Im having a really hard time applying for a car loan and it sucks! 🙂

Thomas Bright

Sorry to hear about that! If you haven’t missed any payments you might still be okay. However, if your lender was expecting payment and sent the account to collections, that could certainly have a negative impact. Does the credit report just list the account or is their negative information associated with it? You might want to call your lender and also ask for some more specifics about the situation and what they are expecting from you in terms of payment.

adriana